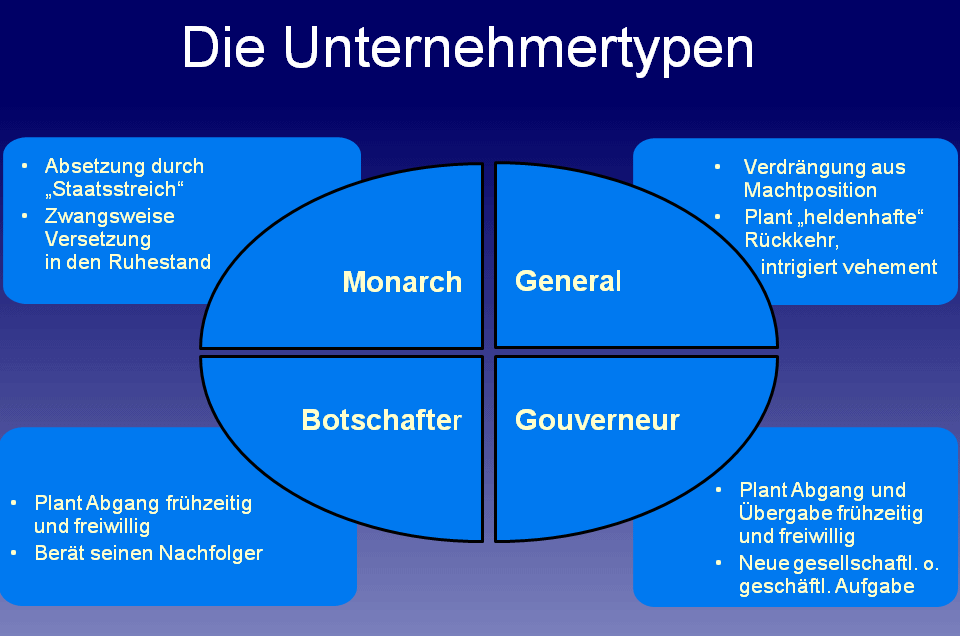

Succession Types

Which type of entrepreneur are you? - In the American literature are very clearly distinguished four basic types of entrepreneurs with regard to succession of family businesses:

This type of business owner is removed from power by a "coup d'état" and more or less forced into retirement.

This type of business owner is ousted from his position of power, but plans his "heroic" return to previous glory and plots with corresponding vehemence.

This type of business owner plans his departure voluntarily and ahead of time and furthermore makes himself available in a consulting capacity to the successor.

This type of business owner plans his departure and the transferal voluntarily and ahead of time in order to separate completely from the company. Then he dedicates himself completely to another main occupation in a business and/or corporate role.