Internal Monitoring and Controlling System

Create Transparency

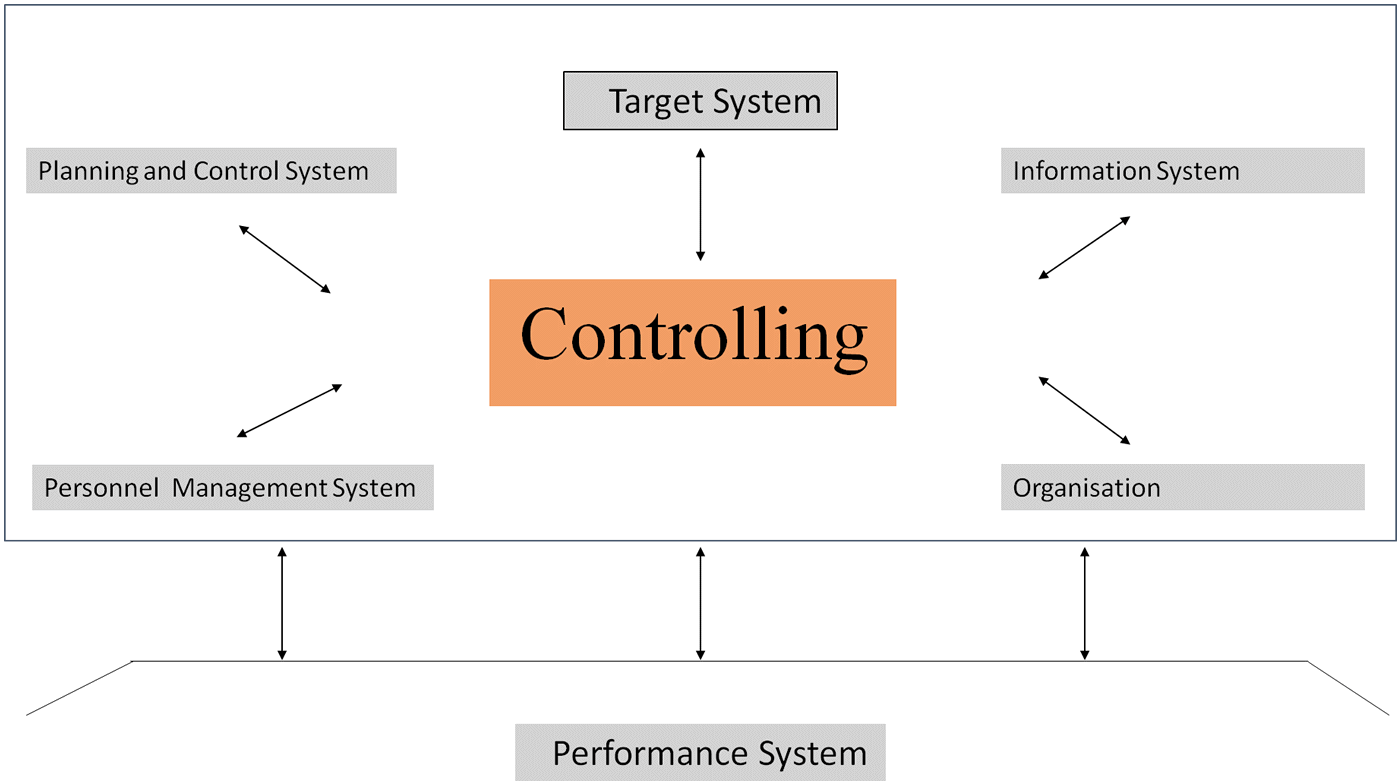

While strategic aims generally are defined at management level the internal controlling as a subsystem has to monitor with its particular instruments the achievement of the corporate targets. The classical functions of controlling include information, control, planning and finally steering and supervision.

Controlling works as an internal service supplier and especially medium sized enterprises, which have to react fast and flexible on changing market conditions need a reliable monitoring system. Knowledge in and about the own enterprise becomes the central resource with the controller as a provider of relevant data.

Nevertheless the importance of a controlling system seems to play a subordinate role - especially in mid-size companies - in spite of higher demands on a transparent and comprehensive reporting information. Having “all relevant figures on the brain” might suffice the entrepreneurs subjective perception but might be insufficient for external investors such as banks and other capital donors.

A constant further development of controlling methods should help to facilitate the management’s decision-making. If these requirements are not fulfilled the enterprise faces a less positive rating and finally in case of a company sale a lower price or even the rejection of a potential purchaser.

Source: Küpper, Hans-Ulrich 1995

Source: Küpper, Hans-Ulrich 1995